Questions from Stakeholders

The companies whose Balance Sheet date is 31.03.2011 or onwards, need to file their financial statements in XBRL provided they qualify the criteria laid as per Ministry’s general Circular 37/2011 dated 07.06.2011.

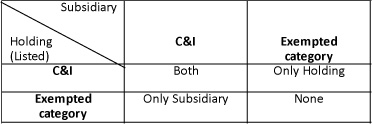

The holding company has to file consolidated financial statement in XBRL. Its subsidiaries also need to file their financials in XBRL.

If the Subsidiary company meets the criteria of phase-I category of companies, they have to file in the XBRL mode.

All such companies, whose financial statements are generated as per accounting requirements other than Schedule VI of the Company Act, 1956 have been exempted from XBRL filing for year 2010-11. The companies regulated by any other act like Electricity Act, 2003, Banking Regulation Act, 1949, Insurance Act, etc are exempted from XBRL filing in the Phase-I filings.

NBFCs that are registered with RBI as an NBFC are exempted from XBRL filing for year 2010-11. Moreover, all Power companies are exempted from XBRL filing for year 2010-11 irrespective of whether Schedule VI is applicable or not.

NBFCs that are registered with RBI as an NBFC are exempted from XBRL filing for year 2010-11. Moreover, all Power companies are exempted from XBRL filing for year 2010-11 irrespective of whether Schedule VI is applicable or not.

The certification of XBRL filing would be done by the professional as before. The professional may use XBRL viewer tool to satisfy himself about the authenticity of XBRL document as per the audited financial statements.

Yes, all the subsidiaries (including subsidiary of a subsidiary of a listed company) of a listed company in India need to file their financial statements in XBRL this year.