Policy Specific FAQs

Previous 11-18

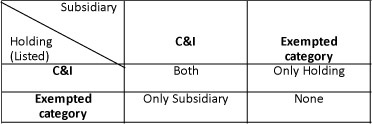

The listed holding company has to file its standalone and consolidated financial statement (if applicable) in XBRL. Its Indian subsidiaries also need to file their financial statements in XBRL.

If the subsidiary company meets the criteria vide Companies (Filing of Documents and Forms in Extensible Business Reporting Language), Amendment, Rules, 2017 Dated 6th November 2017 , it has to file its financial statements in XBRL.

All Banking companies (that are regulated by RBI) and all Insurance companies (that are regulated by IRDA) have been exempted from XBRL filing of their Financial Statements. All NBFCs that are registered with RBI or exempt from registration with RBI but registered with other regulators like SEBI, IRDA, National Housing Bank, etc are exempted from XBRL filings. Further, NBFCs are exempted from XBRL filing irrespective of whether Schedule VI/Schedule III is applicable to them or not.

As per section 129, the financial reporting requirements of Banking, Insurance, NBFC and are different from the Schedule III of the Companies Act, 2013, and thus, the applicable taxonomy for these companies are different from C&I Taxonomy (that is based on Schedule III). The taxonomies applicable to these companies are under development.

However, the C&I Taxonomy 2012 and onwards (including Ind-AS Taxonomy) is based upon reporting requirement as per Schedule III of the Companies Act, 2013, any exempted class of company that has prepared its Financial Statement as per Schedule III may voluntarily file in XBRL if it finds that appropriate taxonomy elements are available in the taxonomy.

However, the C&I Taxonomy 2012 and onwards (including Ind-AS Taxonomy) is based upon reporting requirement as per Schedule III of the Companies Act, 2013, any exempted class of company that has prepared its Financial Statement as per Schedule III may voluntarily file in XBRL if it finds that appropriate taxonomy elements are available in the taxonomy.

The certification of XBRL filing would be done by the professional as was done for XBRL filings. The professional may use the MCA XBRL Validation Tool to satisfy himself about the authenticity, accuracy and completeness of XBRL document vis-a-vis the audited financial statements of the company. Professionals may refer the Guidance provided by the professional institutes for certification of XBRL financial statements. MCA XBRL Validation Tool also provides for printable ‘human readable’ form of XBRL documents that may be used by professionals & companies to satisfy themselves about correctness of the filings.

Yes, all Indian subsidiaries (including subsidiary of a subsidiary) of a listed company are mandated to file their financial statements in XBRL. It may be noted that listed holding company would provide subsidiary details in its standalone instance document, and its subsidiaries would separately file their financial statements in XBRL using e-forms 23AC-XBRL and 23ACA-XBRL/AOC-4 XBRL.

As per MCA guideline, all companies who were required to file in XBRL mode from (FY 2010-11) are mandatorily required to file in XBRL mode for later years as well. MCA recommends that a company which has done filing in XBRL mode in any previous year on or after FY 2010-11 should continue to do so in subsequent years as well even they had filed voluntary.